Small Businesses and the Self-Employed

In honor of Tax and Stimulus Week, we’re taking an extra look at groups who could be left out or need additional government support.

Self-employed people, small businesses, and those with student loans are all potentially vulnerable

In any normal year, this would have been the week when taxes were due. Instead, the deadline for most households to file has been extended to July, and many people began receiving stimulus funds from the federal government. As part of our ongoing interest in understanding the impacts of the COVID-19 crisis, we are identifying vulnerable groups who are either potentially left out of government recovery efforts, or may need extra assistance. This week we take a closer look self-employed people, small businesses, and those with student loans. We’d also like to hear from you. If you or someone you know is being left out of recovery efforts, please tweet @metroplanners, @dgordoncooper, or email your story to lgranger@metroplanning.org.

- In the City of Chicago, there are over 120,000 workers who are self-employed

The 121,240 workers in Chicago who report being self-employed rather than paid salary or wages represents approximately 8% of the workforce. Approximately half of this group provides some professional or technical service.

The majority of self-employed Chicago workers are white (52%), and white self-employed workers are disproportionately in management, business, science, and arts occupations (representing 69% of this category). Latinx people comprise 21% of self-employed workers are disproportionately represented in construction (49%) service (30%), and transportation and moving occupations (29%). Black people represent 17% of all self-employed workers and the majority are in either transportation and moving occupations (27%) and service occupations (26%).

Some of these workers are likely a part of what is referred to as the gig economy, and some are owners of their own business. In either case, this category of worker is not likely to receive direct business support and this vulnerable to additional financial insecurity as a result of COVID-19.

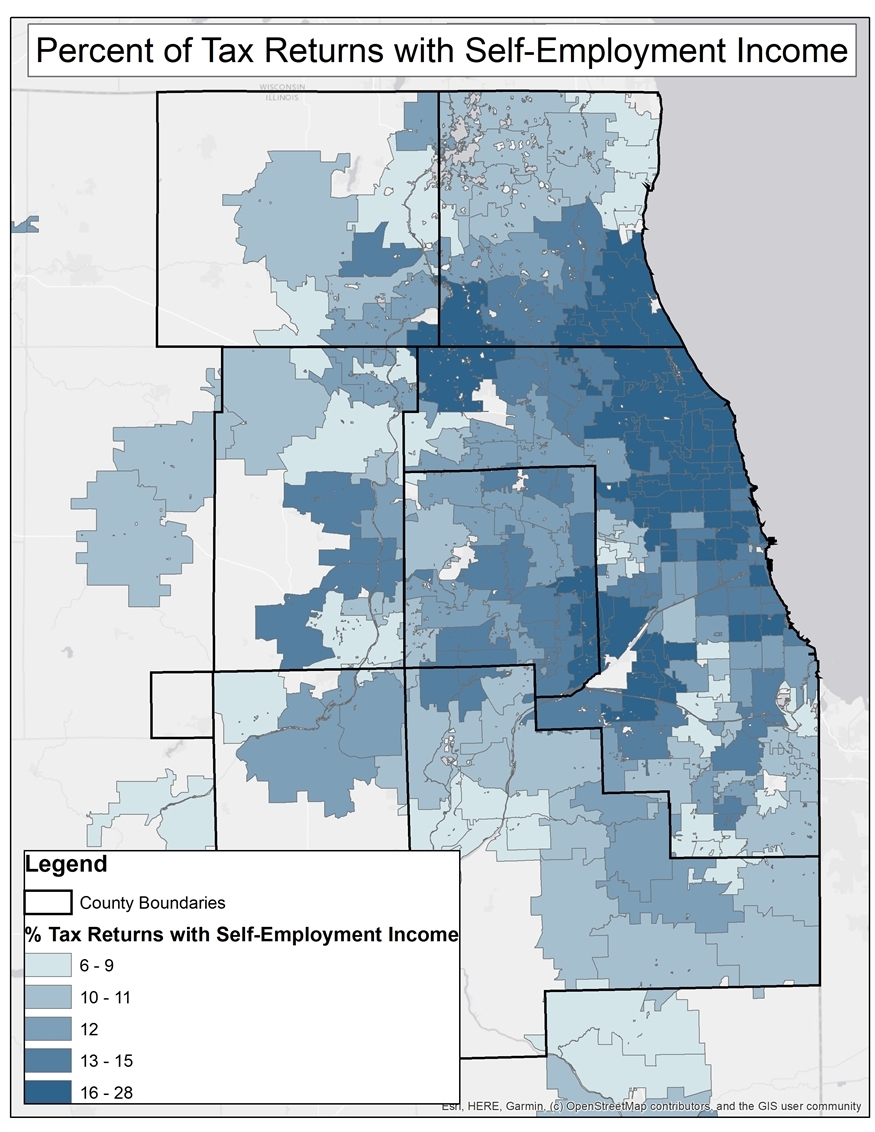

2. People who Pay Any Self-Employment Tax Are Clustered Most Heavily in Cook County

Tax data (from 2017 IRS returns) show us a slightly more nuanced picture. Across the region larger, Cook County has the largest share of individuals (over 360,000 compared to just over 60,000 in DuPage County, the next highest county) who paid any self-employment income. Although not all of these people are primarily self-employed, it is likely that these people have gig and independent income that is at risk due to COVID-19 and will not be helped by government business support.

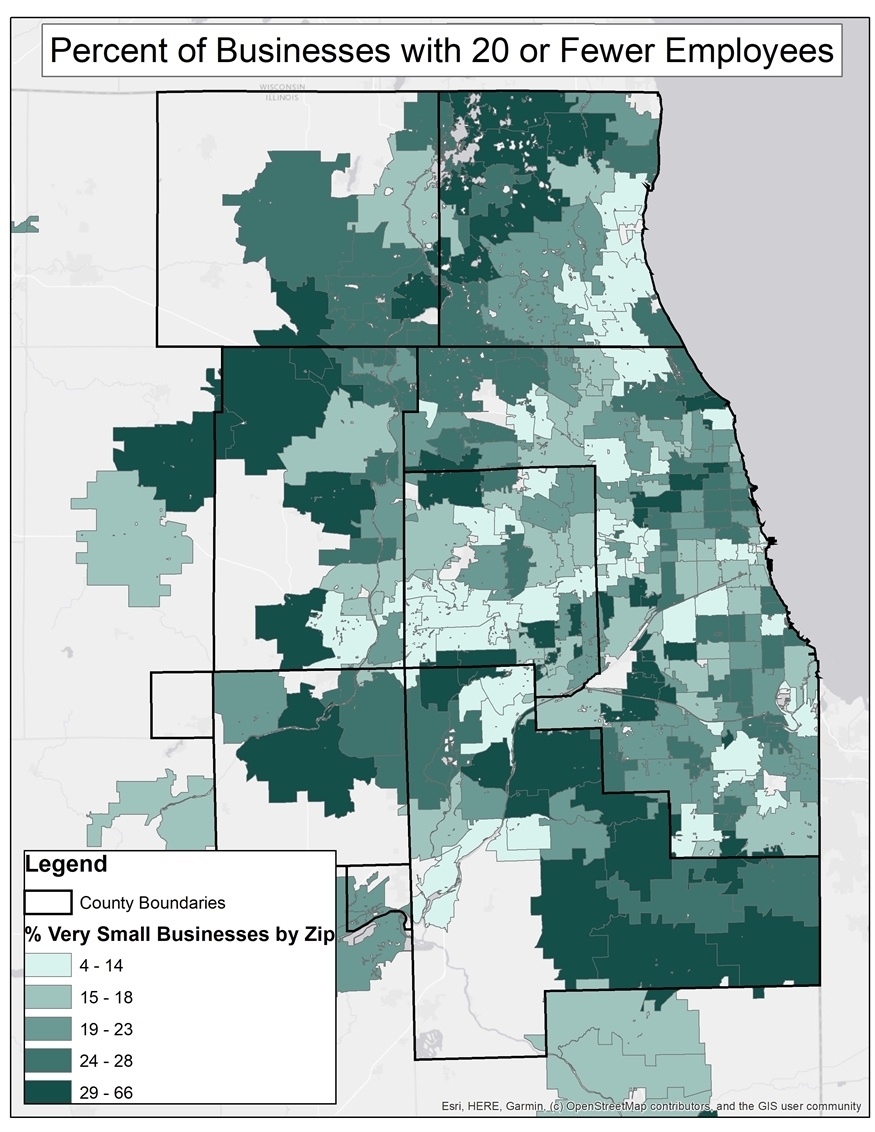

3. Very Small and Young Businesses are Especially Vulnerable, and Are Everywhere in the Region

Small businesses, defined here as 20 or fewer employees, are everywhere in the region, but comprise a slightly larger share of all businesses in the collar counties. Most businesses qualify for government assistance in one form or another, but many small businesses lack access to capital and are extra vulnerable–as are, of course–their employees–despite recovery loans from government.

New businesses that have been in operation no more than three years comprise a smaller share of all businesses in the region, but they play an important role for many areas in Cook County, including some West and South side neighborhoods. Young businesses are more likely to have higher debt and lower cash reserves.

4. Student Debt Will Be a Major Source of Financial Strain for Years, Especially for Young People

Student debt has unfortunately become an accepted cost of entry into the labor market, and goes along with educational attainment. As unemployment continues to skyrocket, young people are the most at risk of being saddled with unemployment and student debt. Although the federal government has provided a 60-day cushion for those with student loan payments, much more will need to be done to ensure the financial security of the many households with student loan debt.

As the COVID-19 crisis continues to unfold, we must be quick to examine the ways that workers and households are vulnerable or not being reached by policy responses. MPC will continue to analyze the growing impacts across our regions and households.