Employer-Assisted Housing 2004 Mid-Year Report

The mid-year report will be updated shortly with new year-end data, including information on more successful homebuyers and more employer sign-ons.

The Metropolitan Planning Council (MPC) and its partners took employer-assisted housing (EAH) efforts in new directions in 2004, continuing programs with the nonprofit Regional Employer-Assisted Collaboration for Housing (REACH) and employers in the six-county Chicago region, building a new partnership with the Statewide Housing Action Coalition (SHAC), laying the infrastructure for EAH to support the Chicago Housing Authority (CHA) Plan for Transformation, and strengthening the relationship with State of Illinois departments and agencies.

EAH Expands Statewide

In 2003, MPC and the REACH partners implementing EAH programs throughout northeastern Illinois completed the pilot round of matching funds provided by the Illinois Housing Development Authority (IHDA). During this pilot phase, IHDA made $270,000 available as a grant to MPC to match dollar-for-dollar the down payment or closing cost assistance provided by an employer to its employees through an EAH program in conjunction with one of the REACH partners in the six-county region.

Also in 2003, IHDA chaired and staffed Gov. Rod Blagojevich’s Housing Task Force, where the EAH model surfaced as an effective way of engaging the private sector in support of homeownership and of addressing the needs of one priority population. EAH was also recognized as a constructive vehicle for advancing intergovernmental coordination on housing issues. The Governor, as part of his 2003 Executive Order, specifically included among the “underserved constituencies” for whom housing resources should be prioritized in the future, low-income workers who cannot afford to live near their jobs. The new State Housing Task Force created by the Executive Order has been working to scale up EAH statewide. The Task Force is refining the state’s role in administering EAH as a rental and development tool (in addition to its current use for homeownership), and exploring how EAH can effectively leverage more private sector investment in housing solutions. As the first step, in early 2004, IHDA agreed to make its matching funds available to employers throughout the state(1). For the new round of matching funds, MPC is partnering with the Statewide Housing Action Coalition. MPC will continue to work with REACH partners in the six-county Chicago region, assisting with outreach and program design, and with the matching fund program for the employees of participating employers. SHAC will play a parallel role in other parts of the state, working with local housing organizations and their partner employers.

EAH is not only a useful tool related to the governor’s Executive Order. It is also a proven strategy for municipalities working to address local workforce housing options. The Affordable Housing and Planning Appeals Act, (AHPAA) passed in late 2003, identified 49 towns throughout the region that must devise housing plans to increase the local affordable housing stock to at least 10 percent of the total housing available. When the Metropolitan Mayors Caucus hosted trainings for affected municipalities, EAH was among the tools introduced. EAH is within the authority of both home rule and non-home-rule communities, and the MPC EAH model enables towns to track progress per the requirements of the AHPAA.

EAH in Support of Mixed Income Communities in Chicago

St. Charles , Riverdale, North Chicago , and Evanston are among the towns that have already launched EAH programs for their own employees. The City of Chicago has been working with MPC to tailor its existing Department of Housing (DOH) homeownership programs to support EAH among city-based employers. This model has proven effective with the University of Chicago and U of C Hospitals, as well as Advocate Bethany Hospital and several other employers. The City is also partnering with MPC to support the success of new mixed-income communities developed as part of the Chicago Housing Authority (CHA) Plan for Transformation(2). On the sites previously occupied by notorious high rises, the CHA’s mixed-income communities are part of a broader neighborhood revitalization strategy, and will serve public housing residents, moderate-income households, and market-rate owners and renters within the same development. Employer participation is key to attaining the desired mix of incomes to further neighborhood redevelopment and promote integration and community reinvestment.

MPC has engaged four new REACH partners in Chicago to work with developers, local employers, and their employees to provide credit and homeownership education for employees. Selected through a Request for Proposals, the new partners include Rogers Park Community Development Corporation, Spanish Coalition for Housing, Housing Choice Partners, and LEED. Genesis Housing Development Corporation, recruited by a leading employer, is also a city REACH partner. These experienced housing organizations will benefit from MPC-organized trainings, including in-depth workshops on DOH programs and on working with employers. MPC is partnering with each housing counseling agency to engage employer EAH partners in connection with CHA mixed-income sites.

The first Chicago employer to commit to helping employees buy homes in a new mixed-income community is the Illinois Institute of Technology (IIT), located on Chicago ‘s South Side. Recognizing the opportunity not only to reward valued employees and reduce turnover but also to help ensure successful community redevelopment, IIT has committed $7,500 forgivable loans to help employees buy homes in the new Park Boulevard (formerly Stateway Gardens ). In addition, IIT reached out to other local employers; the Illinois College of Optometry and DeLaSalle Institute have both signed on to offer employees $2,500 in down payment assistance. IIT will help up to 50 employees, the Illinois College of Optometry will help 20, and DeLaSalle will assist 20. The developer of Park Boulevard , Stateway Associates, has agreed to cover the cost of program administration and homeownership counseling for the employees of these institutions. In exchange, these nonprofit employers will transfer the Illinois Affordable Housing Tax Credits they receive through their investment (valued at 50 percent of their total outlay) to the developer.

The Park Boulevard sales trailer is expected to open in early 2005, and, in fall 2004, employees of the participating employers were invited to a special advance opening to learn about the new housing opportunities. Employees are beginning to work with a housing counselor to be ready when the developer begins accepting contracts. Several other employers and industry groups, such as Chicago Public Schools, Walsh Group, Mellish and Murray , LEED Council, and North River Commission are also in the process of refining EAH programs in support of the Plan for Transformation.

Current EAH Partnerships

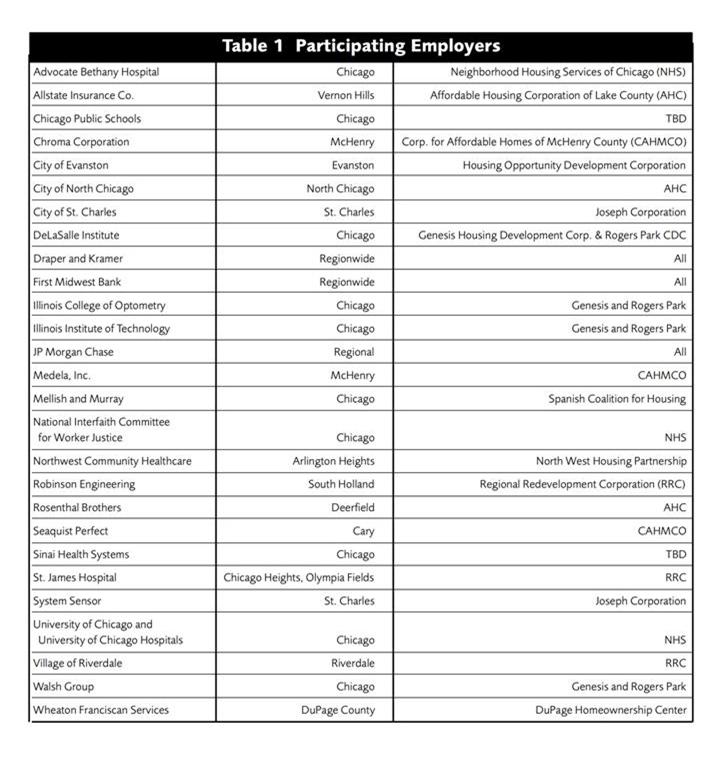

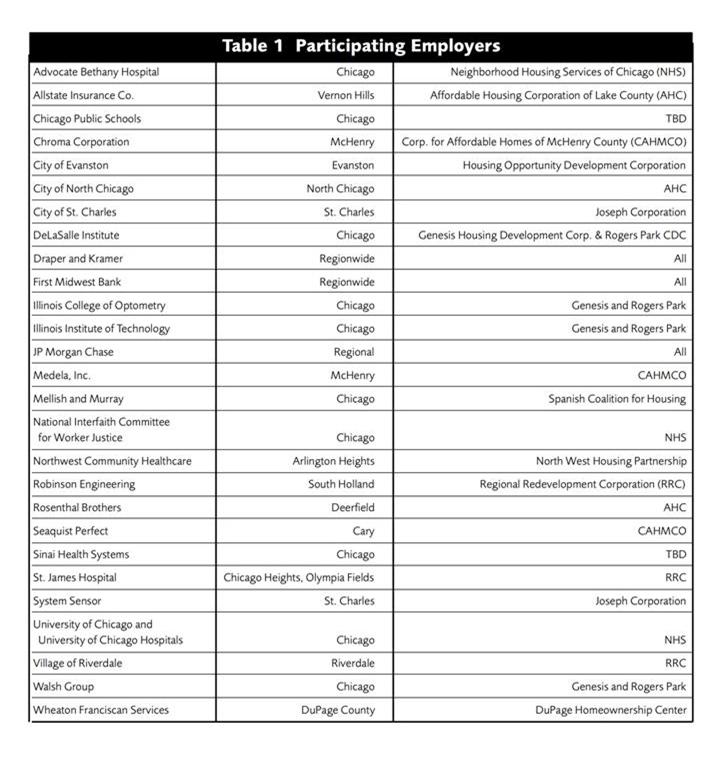

Table 1 summarizes the employers who have committed to launch EAH initiatives using the MPC-REACH model.

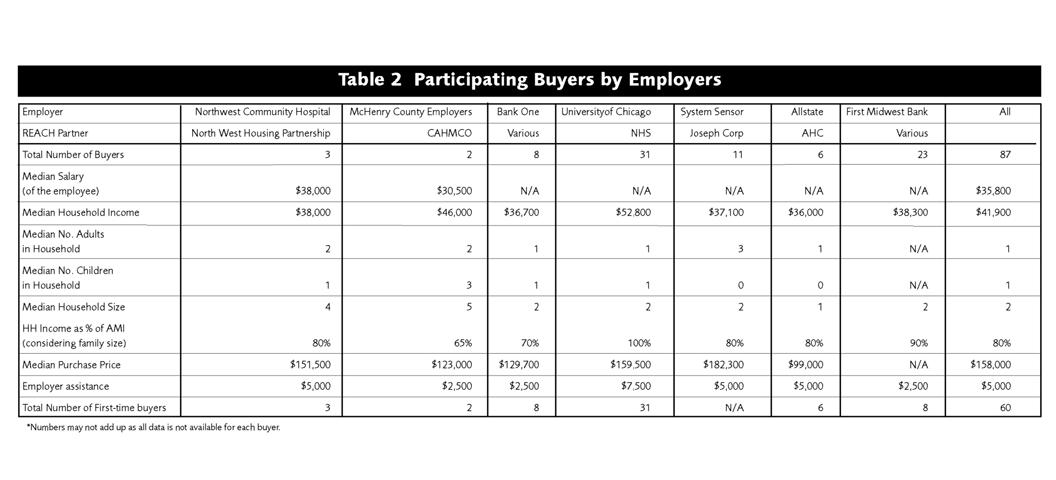

Participating Home Buyers

Table 2 provides more detail about the employees who have bought homes through their company’s EAH initiative. Data are summarized by employer to protect the privacy of individual homeowners. Of the 87 new homeowners in the first three quarters of 2004 (3) (based on available data), employee median salary was $36,000, and household median income was $42,000. The median household size was two people. Overall, the median household income of participating buyers was approximately 80 percent of the Chicago region’s median income. Based on family size and income, 10 buyer households were low-income (under 50 percent of Area Median Income or AMI), 32 were between 50 and 80 percent of median, 20 were moderate-income (between 80 and 100 percent of AMI), and 18 had incomes greater than the median(4). There were 62 first-time home buyers. The program served a diverse clientele, helping 27 white, 16 African-American, six Latino, and ten Asian-American employees buy homes. Home purchase prices ranged from $79,000 to $238,000, with a median sale price of $158,000. Twenty-two buyers accessed the state matching funds, in addition to the assistance provided by their employers.

The REACH partners helped many buyers take advantage of other assistance programs, including the City of Chicago’s TaxSmart and New Homes for Chicago programs, the Federal Home Loan Bank “Down Payment Plus” assistance, Steans Family Foundation first-time homebuyer assistance, programs offered by private lenders, and NHS’ Neighborhood Lending Program. There were also buyers who benefited from the REACH partners’ counseling services through EAH programs but, in the end, bought homes without the employer’s assistance, choosing to purchase outside the parameters of the employer’s program.

Endnotes

(1) To be eligible for the state matching funds, the employee must be a first-time homebuyer. In addition, employees’ household incomes must be less than 80% of the region’s Area Median Income (which is $56,500 for a family of four). Buyers whose household incomes are less than 50% of the region’s AMI (which is $37,700 for a family of four) are eligible for up to $5,000 in matching assistance. Buyers with household incomes between 50% and 80% of AMI can receive up to $3,000.

(2) Announced in 1999, the Chicago Housing Authority has engaged in a “Plan for Transformation,” aiming to undo the historic segregation and isolation of Chicago’s public housing high rises and replace those developments with new mixed-income communities.

(3) University of Chicago and University of Chicago Hospitals data include buyers through Oct. 31, 2004.

(4) Numbers do not add up to 87 total homebuyers because data was not available for all buyers.

MPC is grateful to the following whose funding made this work possible:

- The Partnership for New Communities

- Fannie Mae Foundation

- Polk Bros. Foundation

- Sara Lee Foundation

- University of Chicago

Thanks also to the John D. and Catherine T. MacArthur Foundation and the McCormick Tribune Foundation for their funding of MPC’s Regional Action Agenda, of which this program is a component.